Bitcoin Halving Chart

Key Takeaways

- Bitcoin halvings happen approximately every four years.

- At each Bitcoin halving event, mining rewards are cut by 50% every time.

- It is predominantly believed that Bitcoin halvings have often led to price surges (but we don’t believe that).

Understanding Bitcoin Halvings

The Bitcoin halving is kind of like Bitcoin’s version of a supply cut.

Every four years (give or take), the reward that miners get for validating transactions gets sliced in half. It’s built right into the code so it’s a pre-programmed event within the Bitcoin network.

Why does that matter? Because it slows down the number of new bitcoins entering the market, making it more scarce over time.

Lower supply = price go up (economics 101).

It’s also a big reason why people compare Bitcoin to gold – it’s limited, it’s predictable, and it’s designed to hold value in the long run.

Key Dates for Bitcoin Halvings

Since its introduction in 2009, Bitcoin has experienced four halving events (check out the bitcoin halving chart below). The inaugural Bitcoin halving took place on November 28, 2012. This was succeeded by additional halvings on July 9, 2016 and May 11, 2020 respectively.

Historically speaking, every bitcoin halving has typically resulted in a price increase. If you look at the bitcoin halving chart below, you can see that Bitcoin’s value has appreciated after every Bitcoin halving.

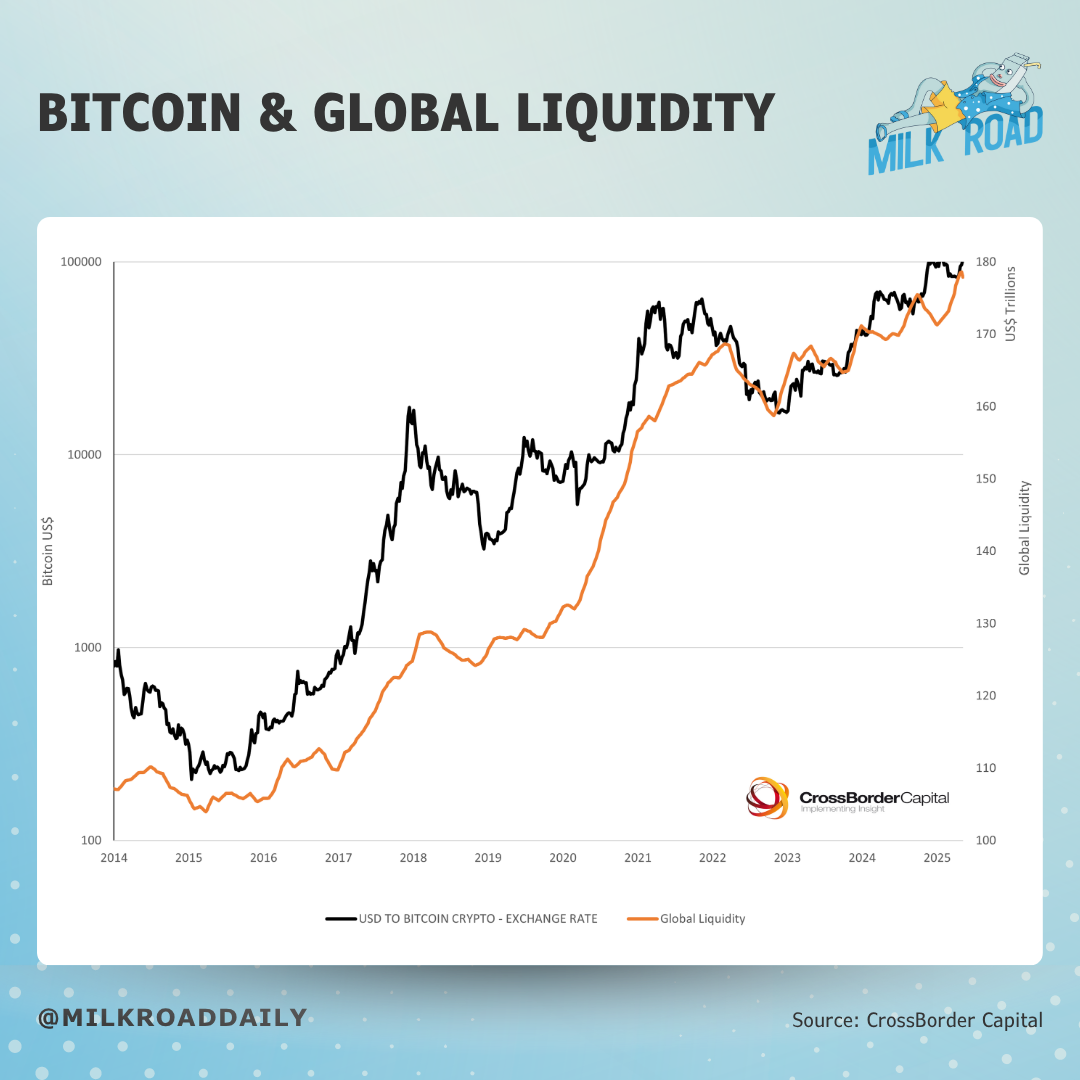

While we do believe that Bitcoin does move in 4 year cycles, we don’t think that Bitcoin halving is what drives these cycles. It’s driven by something called global liquidity – how much money is sloshing around in the world that’s available to be spent, borrowed, or invested.

Scroll to the next section to understand more.

Why Bitcoin Halvings DON’T lead to price increases

There is a common misconception that bitcoin halvings drive the price of Bitcoin every four years.

That’s false. Allow me to explain why.

There’s something called the business cycle which is essentially the growth of the world economy. As the global economy expands, assets tend to expand too (and vice versa).

The best part about the business cycle is that it’s predictable. They grow, they contract and they grow again. 👇

What’s even better is that the business cycle informs the liquidity cycle.

As the global economy goes into a period of ‘expansion’, we see a significant surge in global liquidity (how much money is sloshing around in the world that’s available to be spent, borrowed, or invested.)

But why is global liquidity important?

(Glad I asked).

It’s important because it has a very strong correlation with Bitcoin:

- Higher global liquidity = risk-on = good for Bitcoin and other crypto assets

- Less liquidity = market sentiment is low = rough times ahead

If you need a visual aid to drive the idea home, here it is.

Hope we’ve convinced you that the price appreciations in Bitcoin and crypto assets happen due to global liquidity, not the Bitcoin halvings.

If you want more in-depth insights about the crypto market, we publish reports like these every Saturday.

Go PRO here at just $25 bucks a month.

Alright alright, enough about global liquidity, let’s get back into Bitcoin halvings.

How Bitcoin Halvings Work

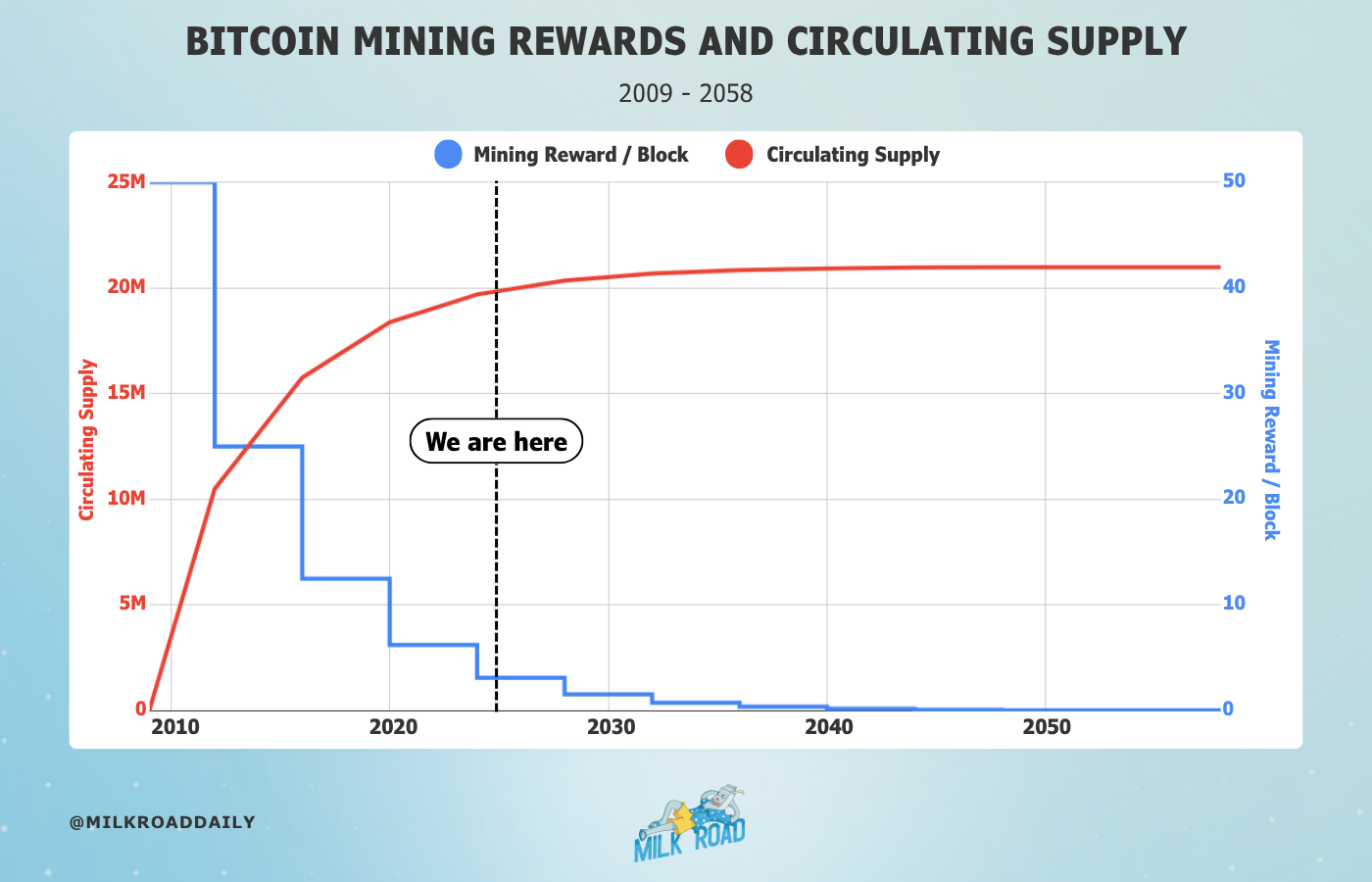

When Bitcoin first launched, miners earned 50 BTC for every block they mined.

But over time, that reward gets cut in half – this is called a halving, and it happens roughly every four years. Check out the bitcoin halving chart below that breaks down the halving visually.

Here’s how it’s gone so far:

- In 2012, the reward dropped from 50 BTC → 25 BTC

- In 2016, it dropped again to 12.5 BTC

- In 2020, it was halved to 6.25 BTC

- And after the most recent halving in 2024, miners now earn 3.125 BTC per block

By looking at the Bitcoin halving chart below, you can estimate when the next bitcoin halving event will occur along with future halving dates.

Next Bitcoin Halving Date

The anticipated next halving event is projected to occur in the middle of 2028. Once this halving event transpires, there will be a reduction in the block reward from 3.125 $BTC to 1.5625 $BTC per block.

It is forecasted that there will be a total count of 29 such Bitcoin halving events until reaching its programmed maximum supply cap at precisely 21 million bitcoins.

While the total Bitcoin supply will not be fully released for the next 100 years, about 19.8M of the 21M $BTC supply has been mined as of May 2025 (roughly 94%).

Preparing for the Next Bitcoin Halving Date

As we draw closer to the forthcoming Bitcoin halving, it’s important for both miners and investors to prepare for the impending shifts.

Investment Strategies

Investors are advised to adopt a buy-and-hold approach to accumulate Bitcoin, focusing on its potential long-term value increase while disregarding short-lived price swings.

By consistently buying Bitcoin at set intervals through dollar-cost averaging (DCA), investors can reduce the effects of market volatility.

Mining Adjustments

It is essential for Bitcoin miners to keep track of the hash rate since it shows how much computing power is on the network

After the halving, mining rewards drop, so miners need to adjust to stay profitable. That means keeping an eye on hash rate trends and tweaking strategies to match market conditions.

To Sum It Up

Bitcoin halving happens roughly every four years, cutting miner rewards in half to reduce the supply of new BTC. While many believe this drives price surges, the real driver is global liquidity (aka how much money is flowing around the world).

So far, Bitcoin’s rewards have gone from 50 → 25 → 12.5 → 6.25 → 3.125 BTC, with the next halving expected in 2028 (which will drop rewards to 1.5625 BTC).

Frequently Asked Questions

Bitcoin halving is an event that happens about every four years where the reward for mining new blocks is cut in half, which helps control the supply of bitcoins.

The next Bitcoin halving date is expected to happen around mid-2028. Mark your calendar!

Bitcoin halving directly impacts miners by cutting their block rewards, which can create financial strain and profitability issues, particularly for smaller operations.

This reduction often forces miners to reassess their strategies and operational costs.

Bitcoin’s price has historically surged after halving events. But it’s a common misconception that bitcoin halvings drive the price of Bitcoin every four years.

It’s driven by something called global liquidity – how much money is sloshing around in the world that’s available to be spent, borrowed, or invested.

A solid approach for the upcoming Bitcoin halving is to use dollar-cost averaging or adopt a buy-and-hold strategy.

BTCC Exchange Review 2026: Fees, Pros, Cons, & Safety

BTCC lets you trade crypto, gold, stocks, and more with up to an insane 500x leverage—and it’s been running since 2011 without a single hack.

SEE MORE

🚨You can thank us later for this 👇 If you currently hold $BTC, $ETH, $SOL, $XRP, $BNB, $AVAX, $ADA and/or $BAT, you’re probably eligible for the Midnight ($NIGHT) airdrop. 👉 And claims will go live in the month of August, here! Putting crypto inside a Self-Directed IRA (SDIRA). “Ok, cool. I love an airdrop… but…